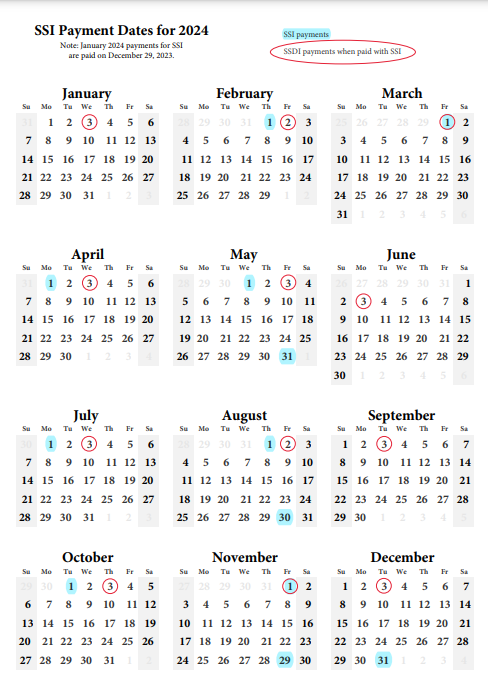

Ssa 2024 Payment Schedule Forms – and is just the second paycheck for 2024 because no payments went out in January due to a scheduling quirk in the Social Security Administration’s calendar. The quirk saw two payments disbursed in . If you are a single tax filer and your combined income is between $25,000 and $34,000, the SSA says you may have to pay income tax on up to 50% of your benefits. If you are a single tax filer and your .

Ssa 2024 Payment Schedule Forms

Source : blog.ssa.gov2024 Payroll Tax & Form 941 Due Dates

Source : www.paylocity.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

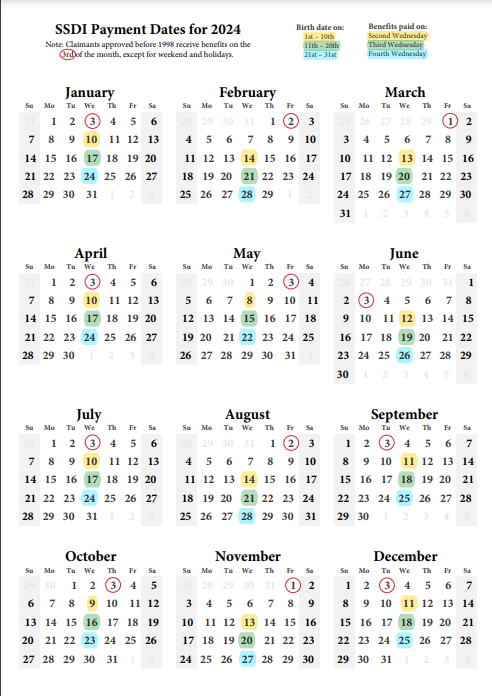

Source : www.nslawservices.orgSocial Security Disability Payment Schedule 2024 | DisabilitySecrets

Source : www.disabilitysecrets.comSocial Security 2024: Payment Schedule for Checks With COLA | Money

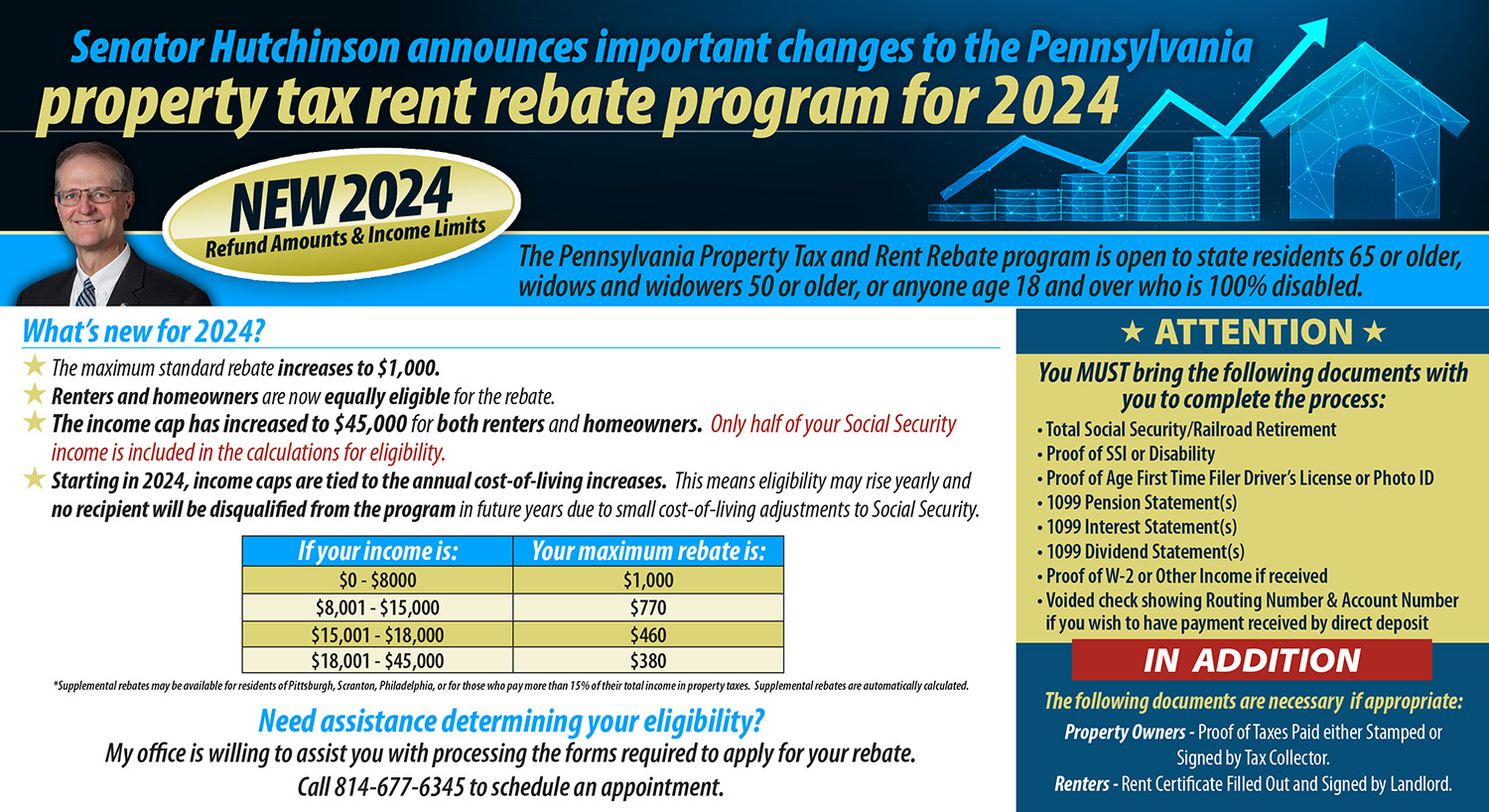

Source : money.comE news Updates January 11, 2024 Senator Hutchinson

Source : www.senatorscotthutchinson.comSocial Security 2024: Payment Schedule for Checks With COLA | Money

Source : money.comPayroll Updates for 2024

Source : www.simonlever.comIRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.comSocial Security Disability Payment Schedule 2024 | DisabilitySecrets

Source : www.disabilitysecrets.comSsa 2024 Payment Schedule Forms Getting Two SSI Payments in One Month | SSA: However, receiving the Initial Determination letter does not mean you HAVE to pay higher Medicare premiums You can contact Social Security using the phone number on the form and schedule an . This guide provides information on the different payroll tax forms and deadlines specific to household employers, helping you navigate the process with ease. .

]]>